Decentralized Finance (DeFi): Next-Gen Finance or a Fraud Scheme?

Context

Introduction to DeFi

- Explanation of decentralized finance and its principles

- The rise of DeFi in the financial landscape

DeFi Features and Advantages

- Decentralization and its benefits

- Financial inclusion and accessibility

Potential Risks and Concerns

- Market volatility and price manipulation

- Smart contract vulnerabilities and security threats

- Fraud Applications in DeFi

Regulatory Environment

- The current regulatory landscape for DeFi

- Future prospects and potential regulations

Real-World Use Cases of DeFi

- Applications of DeFi in lending and borrowing

- Decentralized exchanges and liquidity provision

Is DeFi the Future of Finance?

- Debating the potential and challenges of DeFi

- Expert opinions and projections

- Detecting DeFi Fraud

Conclusion

- Summarizing the key points

Decentralized Finance (DeFi): Next-Gen Finance or a Fraud Scheme?

Decentralized Finance (DeFi) is a concept that has disrupted traditional financial systems, offering an alternative to conventional centralized banking. DeFi operates on a decentralized blockchain network, enabling peer-to-peer transactions without the need for intermediaries. This article aims to delve into the world of DeFi, exploring its features, advantages, potential risks, regulatory environment, real-world use cases, and whether it truly represents the next-generation finance or possibly a fraudulent scheme.

Decentralized Finance (DeFi) refers to a burgeoning sector of the cryptocurrency and blockchain space that is focused on recreating traditional financial instruments in a decentralized architecture, outside the control of traditional financial intermediaries. The core principle behind DeFi is to provide an open, inclusive, and censorship-resistant financial system.

The rise of DeFi has been exponential, primarily due to its promise of democratizing finance. It offers financial services such as borrowing, lending, trading, and more, without the need for a central authority like a bank. This disruption has piqued the interest of many individuals and institutional investors.

Decentralization and its benefits

DeFi’s hallmark feature is decentralization. Traditional finance relies heavily on centralized authorities, making it susceptible to censorship, fraud, and inefficiencies. DeFi, being decentralized, reduces the need for trust in a single entity and promotes transparency and security.

- Reduced Dependence on Intermediaries: Decentralized finance eliminates the need for traditional financial intermediaries like banks, which can reduce transaction costs and increase financial inclusion by making financial services more accessible to a global population.

- Transparency and Trust: Blockchain technology provides a transparent and immutable ledger of all transactions, which fosters trust among participants. Anyone can verify transactions and track the movement of funds, reducing the potential for fraud and corruption.

- Accessibility: Decentralized finance is accessible to anyone with an internet connection, regardless of their geographic location or socioeconomic status. This inclusivity empowers individuals who are excluded from traditional financial systems.

- Ownership and Control: Users have more ownership and control over their financial assets in a decentralized system. Private keys grant access to wallets and assets, reducing the risk of assets being frozen or confiscated by a central authority.

- Innovation: The open-source nature of decentralized finance allows for rapid innovation. Developers and entrepreneurs can create new financial products, services, and platforms without seeking approval from traditional financial institutions.

- Global Reach: Decentralized finance is borderless, enabling cross-border transactions and financial activities without the need for currency conversions and high fees associated with traditional international transfers.

- Liquidity: Decentralized exchanges and liquidity pools offer greater liquidity, enabling users to trade and convert assets quickly and efficiently.

- Interest and Yield Opportunities: DeFi platforms often offer opportunities for users to earn interest and yields on their assets through lending, staking, or liquidity provision.

- Resilience: Decentralized systems are less susceptible to single points of failure or systemic risks. Even if one node or service provider goes down, the network can continue to operate.

- Financial Inclusion: Decentralization can provide financial services to individuals who are unbanked or underbanked, allowing them to save, invest, and access credit.

Financial inclusion and accessibility

DeFi opens up financial opportunities to the unbanked and underbanked across the globe. Anyone with an internet connection can access DeFi platforms, enabling financial inclusion and empowerment.

While DeFi holds immense promise, it’s essential to acknowledge and understand the risks involved.

Market volatility and price manipulation

Cryptocurrencies, including those used in DeFi, are known for their volatility. Prices can swing dramatically in a short period, exposing investors to significant risks.

The DeFi ecosystem, with its immense potential, presents a host of challenges due to its complex functionalities. This section aims to provide an overview of the evolution of DeFi fraud incidents over time, shedding light on how they occurred and their repercussions.

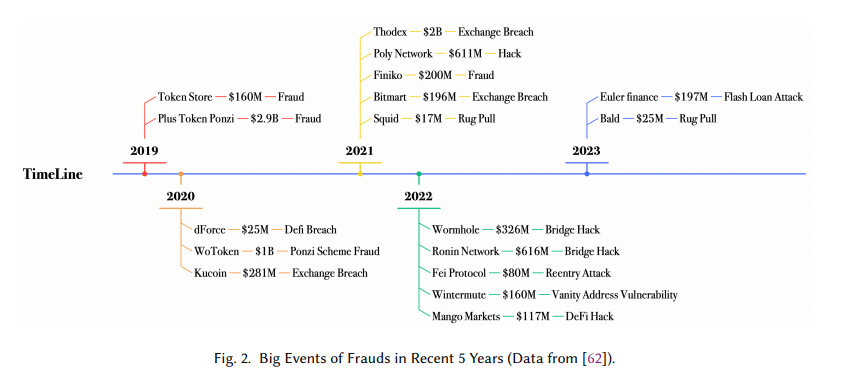

Here are some key observations regarding fraudulent activities in the DeFi space. Firstly, there has been a significant upsurge in fraud within the DeFi market, with security breaches resulting in over $4.5 billion in thefts since 2011, scams causing losses exceeding $7.5 billion, and DeFi hacks leading to the theft of more than $4.81 billion. Secondly, there has been a noticeable shift in cryptocurrency theft methods, favoring DeFi hacks over infiltrating crypto-exchange security systems, particularly after 2021. The ratio of Centralized Exchanges (CEX) to Decentralized Exchanges (DEX) hacks in 2022 was 1:3, highlighting the growing prevalence of DeFi hacks. Thirdly, “rug pulls”, referring to sudden project disappearances, gained prominence among fraudsters in the first half of 2022, with Tornado Cash being a commonly used service for laundering illicitly obtained funds. Additionally, 2021 witnessed a significant trend in NFTs, with a staggering 1,785% increase in market capitalization. However, this surge in popularity made NFTs prime targets for rug pull scammers, resulting in numerous NFT projects becoming victims of such schemes.

Smart contract vulnerabilities and security threats

DeFi relies heavily on smart contracts, which are self-executing contracts with the terms directly written into code. Vulnerabilities in these contracts can lead to financial loss and security breaches.

Fraud Applications in DeFi

As previously discussed at Forbes by David Balaban, DeFi operates on a decentralized platform, allowing users to conduct transactions and resolve financial matters without intermediaries like banks. However, this freedom comes with significant risks. Users bear the full responsibility for the security of their assets, and any loss of access to the wallet key results in permanent asset loss.

His article highlights the increased incidents of security breaches and hacks in the DeFi space, with protocols being responsible for the majority of stolen cryptocurrency. Infrastructure failures and smart contract vulnerabilities pose a considerable threat, as demonstrated by a major hack resulting in a $611 million theft. Additionally, the complexity of DeFi transactions makes them harder to trace and regulate.

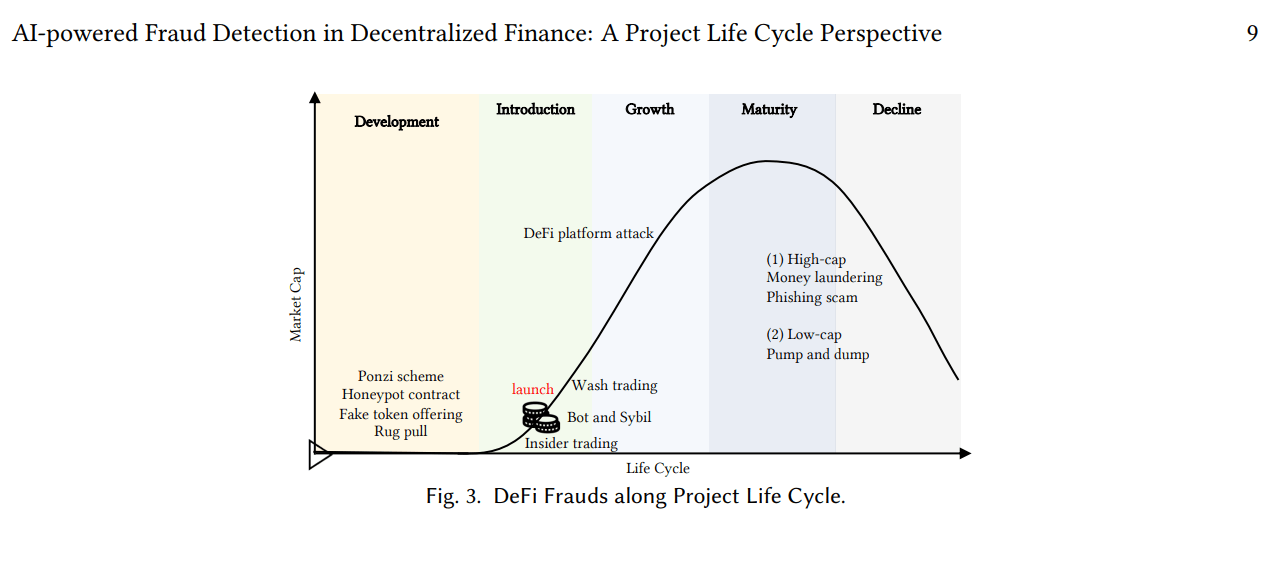

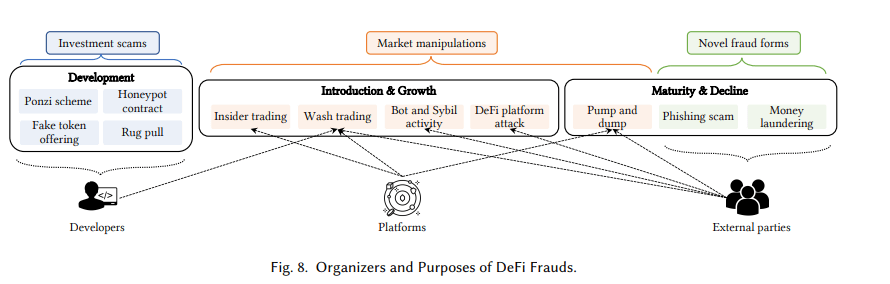

Considering the clear connection between the incidence of fraudulent activities and the different phases of DeFi projects, it is essential to create a comprehensive DeFi fraud classification system that spans the entire life cycle of the project. To this end, we propose a taxonomy based on the principles of the Product Life Cycle Theory, delineating five pivotal stages: development, introduction, growth, maturity, and decline, as illustrated in Figure 3.

Numerous common fraud schemes tend to manifest during the introduction and growth stages, in line with our observations of these issues extending into the maturity and decline stages. Therefore, we have amalgamated the introduction and growth stages, as well as the maturity and decline stages. Below, we elucidate the specific types of fraud associated with each of these stages:

- Development: In the developmental phase, fraudulent projects, such as Ponzi schemes, honeypot contracts, counterfeit token offerings, and rug pulls, are concocted to mislead investors. These projects frequently crumble shortly after their launch, causing substantial losses to investors.

- Introduction & Growth: The introduction and growth phases denote the initiation of the project and its subsequent rapid expansion. Concerns have arisen regarding activities like insider trading, the manipulation of project market dynamics through bot and Sybil accounts, and wash trading. These activities exploit vulnerabilities in DeFi platforms, such as front-running and flash loan attacks, as the project’s value and user base expand.

- Maturity & Decline: When a project progresses into the maturity and decline phases, a different set of financial frauds comes into play. High-cap projects become appealing targets for various financial crimes, including money laundering and phishing scams. Conversely, low-cap projects are susceptible to pump and dump schemes due to their small market capitalization, making them relatively easy to manipulate.

The current fraud landscape for DeFi

Fraud in the DeFi space is still evolving and varies across jurisdictions. Governments are attempting to define rules and frameworks to govern DeFi while balancing innovation and consumer protection.

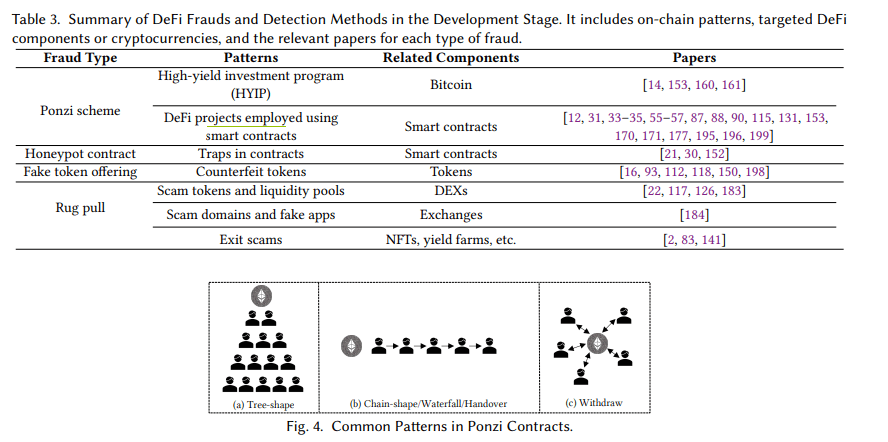

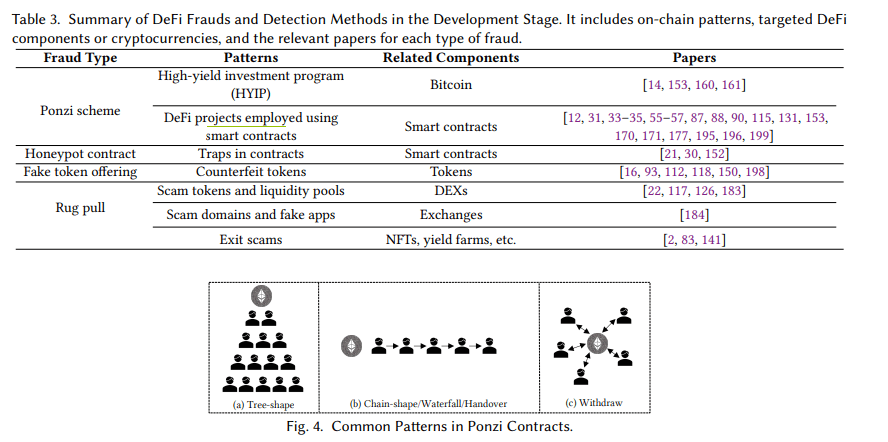

As you can see in the following table, most common fraud types are used perfectly in alignment with mostly related components of DeFi such as Bitcoin, Smart Contractors, etc.

To understand how it works, you have to understand the meaning of a Ponzi Scheme.

What is Ponzi Scheme?

A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. A Ponzi scheme is a fraudulent investing scam which generates returns for earlier investors with money taken from later investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers.

Source: Ponzi Schemes: Definition, Examples, and Origins (investopedia.com)

The Genesis of Ponzi Schemes

Ponzi schemes are named after Charles Ponzi, who in the early 20th century masterminded one of the most infamous frauds in history. These schemes prey on the allure of quick, high returns with minimal risk, luring investors into a seemingly profitable trap.

Future prospects and potential regulations

The future regulatory landscape for DeFi remains uncertain. Striking the right balance between regulatory oversight and fostering innovation will be a challenge for policymakers.

As shown in the below figure, you can understand the difference between Traditional Finance and Decentralized Finance. The growth of DeFi projects has attracted many fraudsters’ eyes, which has resulted in multiple financial losses across multiple sectors. If not properly regulated, it’ll cause a huge impact to the financial system.

Applications of DeFi in lending and borrowing

DeFi platforms facilitate peer-to-peer lending and borrowing, offering competitive interest rates and more accessibility than traditional banks.

Here are some of the key applications of DeFi in lending and borrowing:

- Decentralized Lending Platforms: DeFi lending platforms, like Compound, Aave, and MakerDAO, enable users to borrow and lend assets without traditional intermediaries. Borrowers can collateralize their assets to take out loans, while lenders can earn interest by providing liquidity to the platform.

- Stablecoin Loans: Users can deposit stablecoins like DAI as collateral and borrow other cryptocurrencies. This provides a way to access liquidity while avoiding the volatility often associated with cryptocurrency assets.

- Yield Farming: Yield farming involves users providing liquidity to liquidity pools on decentralized exchanges or lending platforms in exchange for yield in the form of interest or tokens. Users can earn a return on their assets by participating in these liquidity pools.

- Flash Loans: Flash loans allow users to borrow funds without collateral as long as they repay the loan within a single transaction block. These loans are often used for arbitrage opportunities or to address temporary liquidity needs.

- Peer-to-Peer Lending: Some DeFi platforms facilitate peer-to-peer lending and borrowing, where individuals can create loan requests and negotiate the terms directly with lenders.

- Collateralized Debt Positions (CDPs): Platforms like MakerDAO use CDPs, where users lock up collateral, typically in the form of Ether (ETH), to generate stablecoin loans (e.g., DAI). Users can manage their CDPs and liquidate them to retrieve their collateral or pay off their debt.

- Algorithmic Stablecoins: DeFi projects have introduced algorithmic stablecoins like Ampleforth and Terra. These coins automatically adjust their supply to maintain price stability. Users can lend and borrow these stablecoins.

- Interest Rate Swaps: Some DeFi protocols allow users to enter into interest rate swaps to manage their interest rate exposure, potentially locking in fixed or variable rates for their loans.

- Undercollateralized Loans: DeFi platforms are exploring undercollateralized loans, which rely on reputation and credit scores rather than collateral. This approach is still in its early stages and poses additional risks but can offer more traditional lending experiences.

- Global Access: DeFi lending and borrowing are accessible to anyone with an internet connection, offering financial services to individuals in regions with limited access to traditional banking.

- Automated Liquidity Provision: Users can earn interest and fees by providing liquidity to decentralized exchanges or liquidity pools, such as Uniswap or SushiSwap.

- Cross-Chain Lending: Some DeFi platforms are expanding to support lending and borrowing across different blockchain networks, allowing users to access assets on various chains.

Decentralized exchanges and liquidity provision

DeFi has given rise to decentralized exchanges (DEXs) where users can trade cryptocurrencies directly without relying on a centralized entity. Additionally, users can provide liquidity to these DEXs and earn rewards.

Debating the potential and challenges of DeFi

DeFi’s potential to reshape finance is immense. It could provide financial services to the underserved, increase efficiency, and reduce costs. However, challenges like scalability, security, and regulatory hurdles need to be addressed.

As illustrated through the DeFi Product Lifecycle above, we can agree that in such schemes of fraudulent activities, will somehow draw itself into the following purpose:

Expert opinions and projections

Experts hold diverse views regarding DeFi’s future. Some see it as the next frontier in finance, while others emphasize the need for caution and further development.

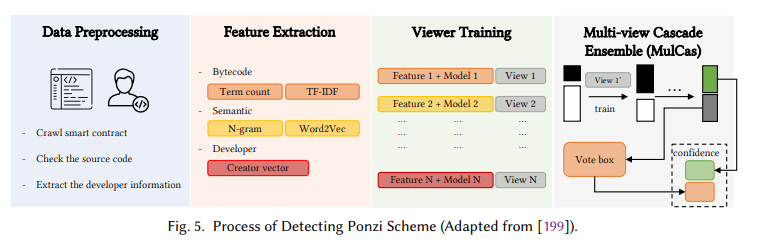

Detecting DeFi Fraud

Detecting Ponzi Scheme in Decentralized Finance include two sides of the coin [Manual Analysis, and AI Detection/Analysis] Both have to include Data Preprocessing steps, and complete understanding of the data dimensions and interpretability of the used data to be utilized for fraud detection.

- Manual Analysis: Experts manually investigate online forums and smart contract code for suspicious activities. For example, Vasek and Moore examined Bitcoin Talk and subreddit threads to categorize Bitcoin frauds, such as Ponzi schemes. They expanded their study to identify Ponzi schemes targeting Bitcoin users by analyzing more Bitcoin Talk threads. Similarly, Bartoletti et al. manually inspected Ethereum smart contract codes to uncover hidden Ponzi schemes using techniques.

- AI Detection Methods: Researchers employ AI methods to detect Ponzi schemes, overcoming scalability and subjectivity limitations. For Bitcoin Ponzi detection, Toyoda et al. used XGBoost and RF models to identify HYIP-associated Bitcoin addresses, enhancing accuracy. Bartoletti et al. improved detection in Bitcoin using cost-sensitive Random Forest classifiers. For Ethereum Ponzi contracts, researchers-built machine learning models using various features, including account, opcode, developer information, and NLP techniques.

In conclusion, DeFi represents a paradigm shift in the financial landscape, challenging traditional banking systems. Its emphasis on decentralization, accessibility, and financial inclusion is noteworthy. However, as with any disruptive innovation, it comes with inherent risks and challenges. Striking the right balance between innovation and risk management will define DeFi’s role in the future of finance.

FAQs

Q1: Is investing in DeFi safe?

Investing in DeFi carries risks due to market volatility and security concerns. It’s essential to research and understand the risks involved before participating.

Q2: Can DeFi replace traditional banking?

DeFi has the potential to offer alternatives to traditional banking, but widespread adoption and regulatory challenges need to be addressed before it can replace traditional banking entirely.

Q3: How can I get started with DeFi?

To start with DeFi, you need to research platforms, understand how to use wallets, and be well-versed with the risks involved. Start with a small investment and gradually increase your exposure.

Q4: Are DeFi transactions anonymous?

DeFi transactions are not entirely anonymous; they are pseudonymous. While they don’t reveal personal information, they can be traced back to wallet addresses.

Q5: Where can I learn more about the subject?

You can read the following research paper that I sited some of the above graphs from to widen your understanding of the subject. AI-powered Fraud Detection in Decentralized Finance: A Project Life Cycle Perspective (arxiv.org)

I’ve been browsing online greater than three hours these

days, yet I by no means discovered any interesting article like yours.

It’s pretty worth enough for me. In my view, if all site owners annd bloggers made good content as you probably did, the net shall be much more helpful than ever before.

Thanks a lot, my dear. Much appreciated!

Please follow me on LinkedIn to see more insights regarding Fraud Management and RegTech!