Future of FinTech: Close Banking vs Open Banking

Welcome to the first article in the new series of The FinData Lake: Future of FinTech. Here we discuss and analyze the current potential scenarios of financial technology and its impact on consumers and financial institutions. In case you are not familiar with what FinTech is, I suggest reading this great definition that Julia Kagan wrote on the Investopedia platform.

Introduction

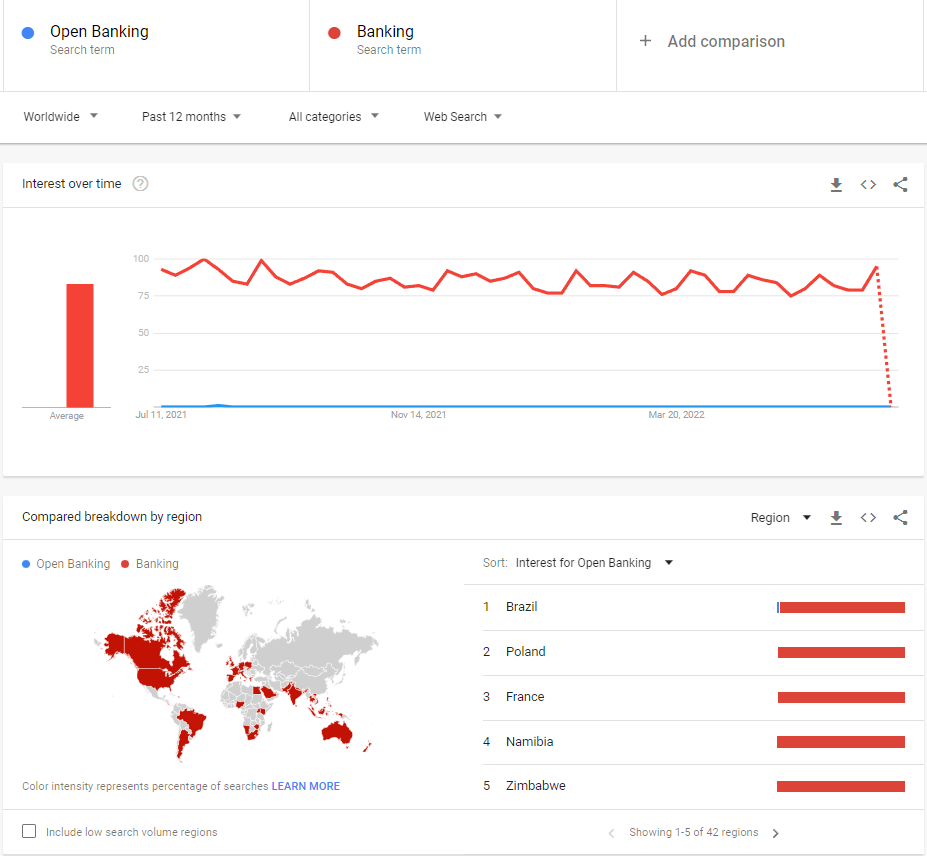

Have you ever come across the term “Open Banking” and did not know what it means precisely? You’re not alone. As this terminology is not getting its recognition properly, according to Google Trends, ONLY mean<1 of the searches for “Open Banking” against mean>80 of the searches for “Banking” using Google web search.

As you can see, it’s barely a flat line with no mean value at all compared to the traditional “Banking” search. If you’ve never heard of it before, this article will enlighten you with its details and how it does work. and you must be asking yourself now: What is Open Banking?

Open Banking

🔒 Close Banking

Close Banking /or so-called ‘Banking’/ is a closed ecosystem in which banks have been slow to adopt new technologies. Banks are not user-centric and don’t care about their customers’ needs and wants. Most of the time, they are not digital-first, agile, or open.

Banking is an old system; it was created for the times when the paper was king and people had no way of connecting with each other unless they were physically present at a bank branch or ATM machine. The services provided by banks have remained largely unchanged over the last few decades, despite numerous technological advancements in the meantime.

🔓 Open Banking

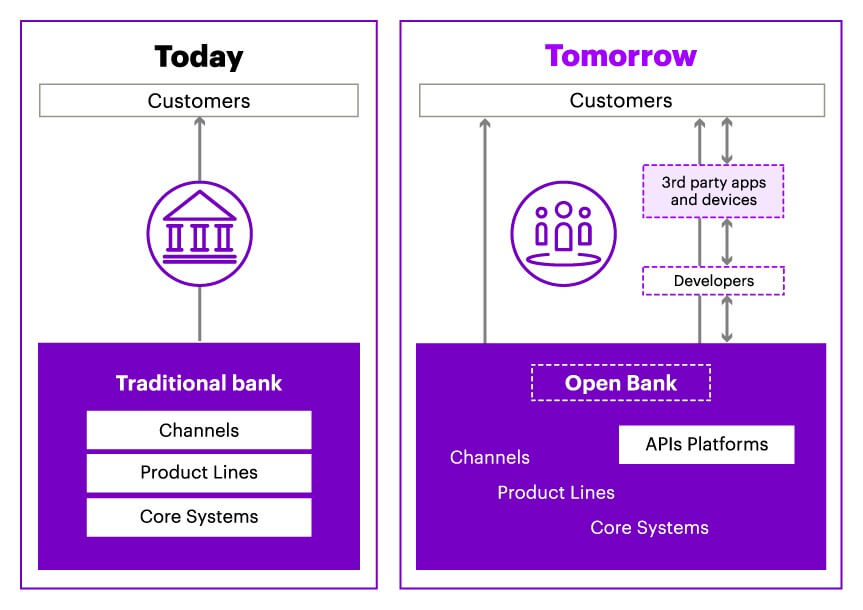

Open banking is the process of providing access to financial institutions’ customers’ data through an API platform. The API platform enables authorized third-party providers (TPPs) to have secure access to bank accounts and use customer data for better services. Banks and financial institutions can capitalize on Open Banking by increasing their product and service offerings; extending their reach beyond their traditional geographic boundaries; reducing operational costs; improving efficiency, speed, and scalability of processes; and further developing innovative business models. It is a new concept that is transforming the way banks and financial institutions interact with their customers. It’s also referred to as “Bank-as-a-Platform,” or BaaP, and it involves allowing customers to share their data with third-party providers. The regulations that govern this practice are called PSD2 (Payment Services Directive 2).

🏦 Banking and finance are moving from “closed” to “open”.

The Open Banking Standard is a new way to do banking, and it’s more convenient for customers. It allows you to access your bank account from any device using an app or software provided by your bank or another company that offers banking services like PayPal or Apple Pay. You can also share information about your financial accounts with third parties like online shopping sites, travel agencies, and online investment advisors.

The bank of today versus the bank of tomorrow: Open Banking in action. (Source: Accenture)

For example, if you sign up for a credit card through Amazon Payments (which has its own open banking service), Amazon will have access to details about how much money is in your account and what purchases have been made on the card. This will allow them to make more accurate recommendations about products that might interest you based on what they know about past purchases made with other products they sell through their platform.

💻 Digital Transformation and Payment Automation

Digital transformation is a strategic goal for many businesses, but it’s not always easy to achieve. The reason is that many companies struggle with the technical barriers of automating their processes, integrating new technologies into their existing systems, and getting employees on board with the changes they need to make.

One way to overcome these obstacles is through payment automation—a strategy that can help companies manage cash flow more efficiently as well as execute other business goals such as reducing costs or increasing revenue streams. Payment automation can be especially valuable for banking institutions because it offers an avenue for banks to use technology to streamline operations and offer their clients better services in a cost-effective way.

🔬 Sandboxing in the Regulator’s POV.

The sandbox journey is not as hard as most imagine. It is being adopted by financial regulators in order to put together the correct roadmap for startups in order to drive the project forward on good ground.

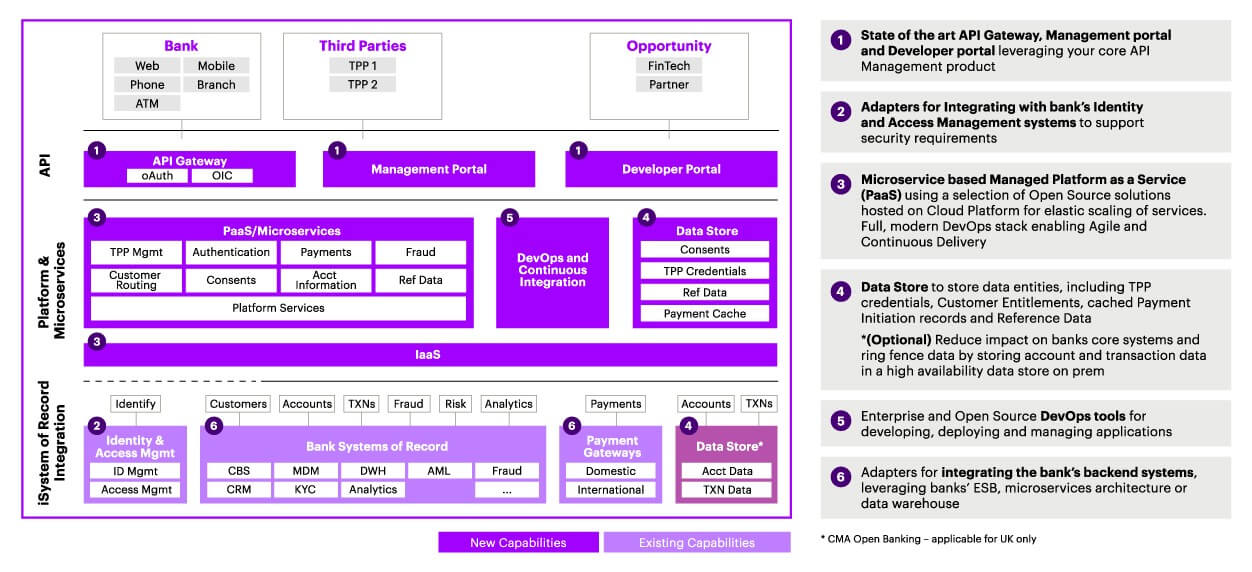

As illustrated below, most likely, those who have a genuine idea will enter the opportunity frame, either as a FinTech entity or as a Business Partner. Everything else follows a static roadmap for the correct management of the project. From handling API Gateway as the first step to constructing a solid foundation of the system and record integration in coordination with Fraud, Risk, and Analytics base that will serve in a loop for other parts of the process, back and forth.

Accenture’s “Open Banking in a Box” solution. (Source: Accenture : “Open Banking Saudi Payments” PPT (2021), p12.)

🚫 Are Regulators Really Against Innovation?

In short: no. There is no doubt that today’s FinTech initiatives are actually providing solutions to our problems. It has gone from being just a random app on your phone to an integrated solution that big companies and enterprises use.

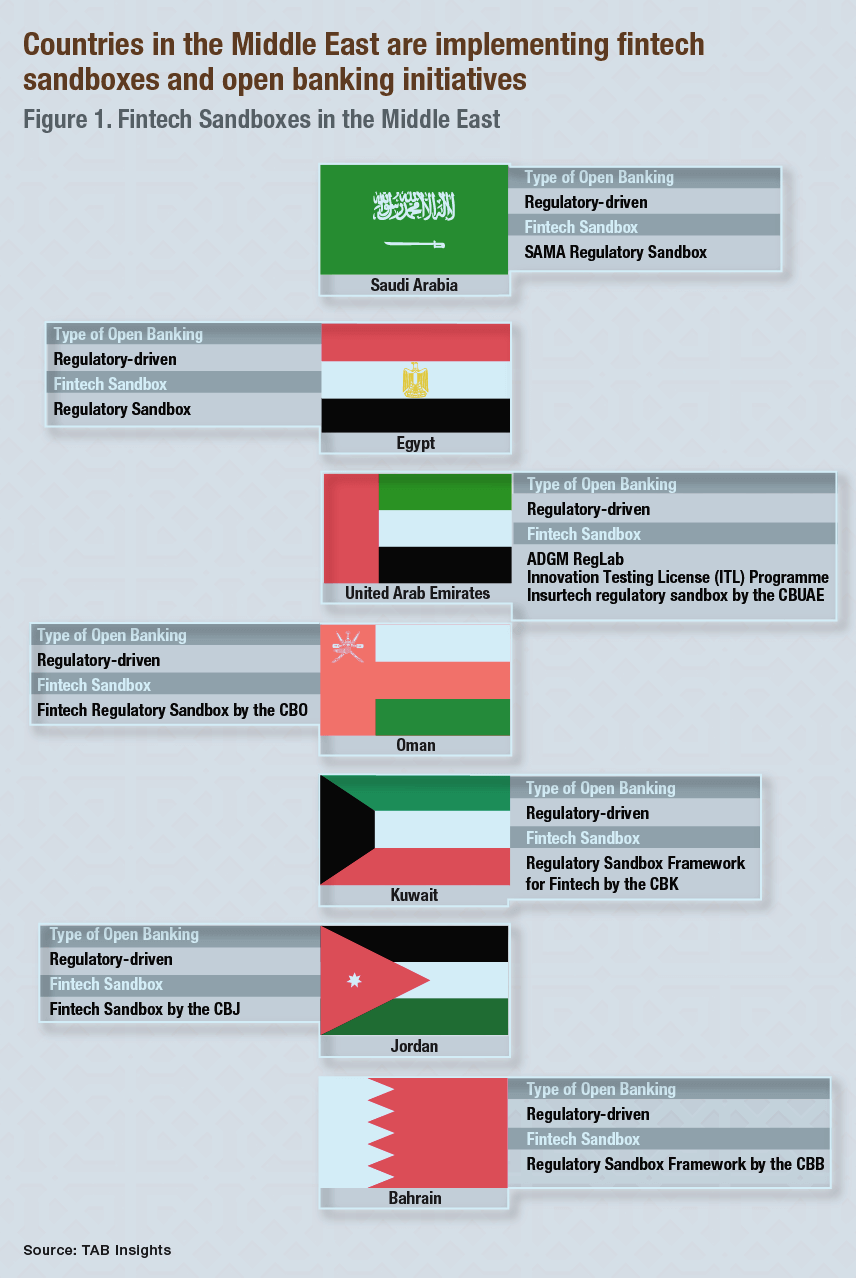

But the main misconception that people tend to understand from this scenario, is that financial regulators are cutting all possible development opportunities for such a rise. When, in fact, that’s completely incorrect. TAB Insights has released some valuable information that discloses the implementation process of FinTech Sandboxes and Open Banking initiatives.

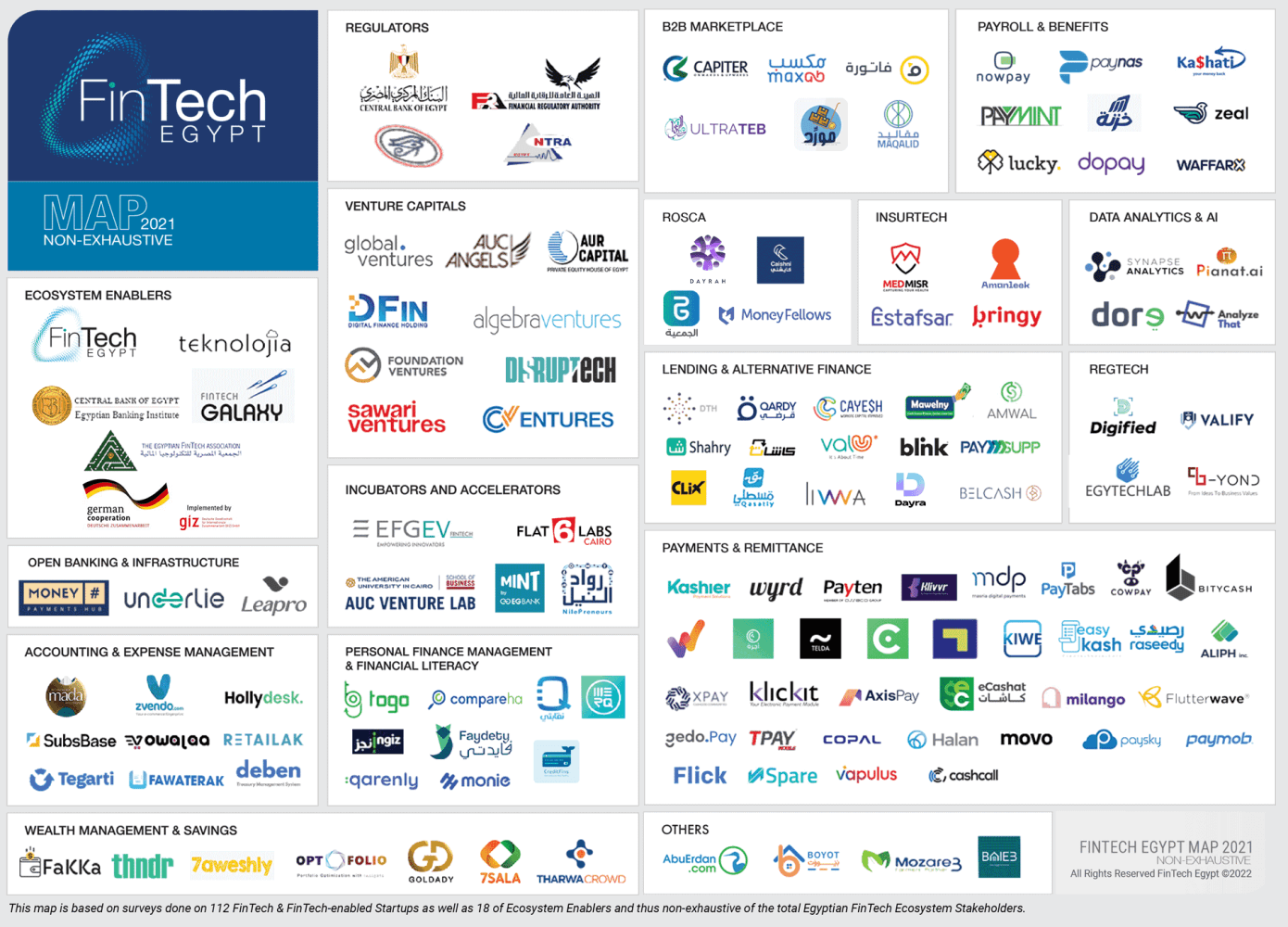

A great example to discuss is the Egyptian Initiative towards FinTech Development. As the Central Bank of Egypt is continuously developing the image base of what the next scene of FinTech will be presented to the masses in Egypt. Towards that goal, CBE has published a well-defined report that illustrates all the critical points in this journey to drive the economy forward using new and improved FinTech solutions.

The report sheds light on the local FinTech and FinTech-enabled startups and entrepreneurs, in addition to FinTech Ecosystem stakeholders such as incubators, accelerators, investors, and supporting organizations.

You can get a copy of the report here.

🥷🏻 Fraud monitoring will become easier thanks to APIs.

Keeping a close eye on resource quality is a vital thought for banks. Assume the acknowledgment risk process, for example. For banks in the Middle East, this can now and again be a wasteful, time-consuming, and somewhat exorbitant cycle. Many banks will generally require paper duplicates of bank explanations, yet these can be effortlessly controlled.

A much better arrangement is to get the necessary data from a solid source by carefully utilizing APIs. Doing so brings various advantages: it cuts the potential for misrepresentation, brings down costs, speeds handling times, and further develops the client experience.

An extra thought is a gamble that the nature of resources held by certain banks in the locale could crumble. Banks can enhance that gamble by utilizing APIs to use ongoing or closed-end data from inner and outside sources, and coordinate those into, for instance, an early-cautioning flagging framework.

Doing so wouldn’t just give banks the choice to utilize various wellsprings of data to screen that risk; producing it in this way would prevent them from being required to persuade clients to offer such information in any case.

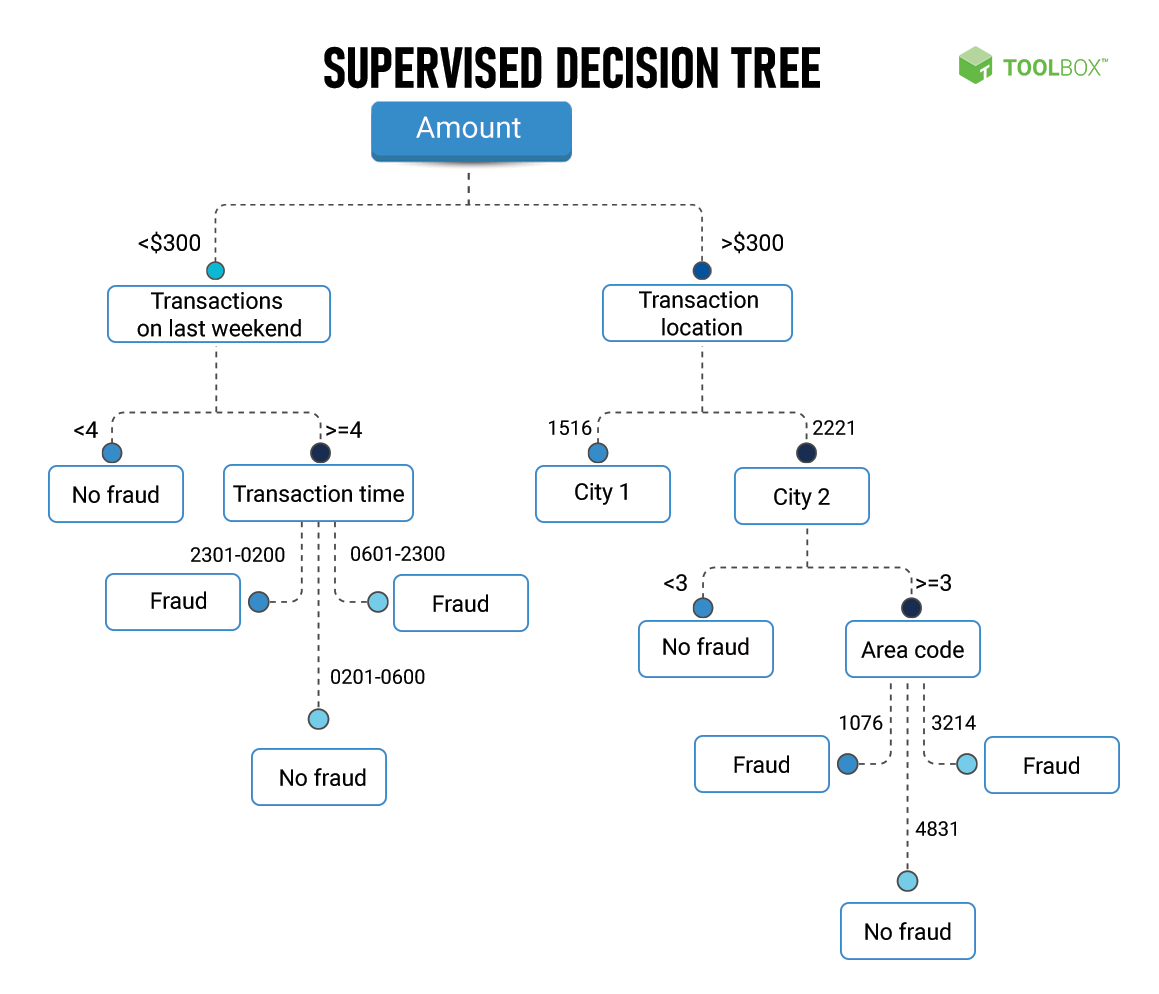

Banks could likewise apply the API-driven environment standard to one more key area of business: monitoring. It’s feasible to robotize the whole monitoring process by utilizing open APIs and joining that with advances like AI and ML. The below example is a prime ML example of a supervised decision tree that teaches itself how to behave at certain events when needed to have a quick decision regarding the authorization of transactional flow.

🏢 Is it inclusive to SMEs and corporates as well?

Yes, it is. To lend in the SME/Corporate realm, you have to understand the validation of two things: data and collateral.

Data as a Lending Validation Tool

You will rely on specific presented data in order to underwrite a facility for the said SME/Corporate that needs it. It varies from one FI to another, but most probably we can agree that it will need the following:

- Income Statement

- Governmental Paperwork

- Liquidity Information

Collateral as a Lending Validation Tool

Collateral is an asset pledged by a borrower to a lender (or a creditor), as security for a loan. Borrowers generally seek credit in order to purchase things—it could be a house or a car for an individual, or it could be manufacturing equipment, commercial real estate, or even something intangible (like intellectual property) for a business.

It will use the following as its metric benchmark:

- Fair Market Value (FMV): FMV is an estimate of an asset’s “price” if the timing were not of the essence and if multiple informed parties were involved in a standard bidding process.

- Orderly Liquidation Value (OLV): OLV provides an estimate of “price” if time were of some priority and the asset was to be sold in an “orderly” auction process.

- Forced Liquidation Value (FLV): FLV asks what “price” an asset might fetch if time were of the absolute essence and a creditor needed to sell this asset without the benefit of an orderly auction process.

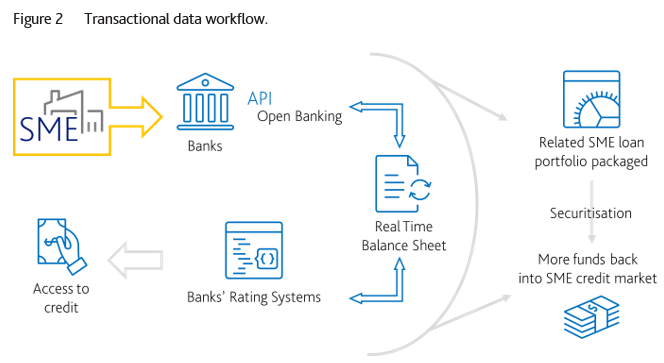

Once you lay down the foundation of the above-mentioned points into an app, you get the famously-named “Transactional Data Workflow” that allows you to automatically perform those actions in real-time with no need of human intervention.

Source: Moody’s Analytics: Open-Banking: Real-Time Analytics for Small and Medium-Sized Enterprises

🛫 The Takeaway

We have seen that open banking is here to stay and is growing at a fast pace. We have also discussed how Open Banking allows for more innovation and efficiency in the fintech space. We also observed that this allows for a better customer experience as financial institutions (FIs) are increasing their focus on delighting customers by improving the user experience. The closing question becomes, “When will my bank or credit union start offering open banking?” There are many factors that should be considered when deciding whether your FI should consider offering Open Banking, such as regulatory expectations, business model, risk management, data privacy and security, internal competencies, and potential acquisitions.

❔Thoughts

Tell me what you think is demanded from financial analysts nowadays. What can be improved further, from your point of view? Do you think that the applicability of changing your organization’s culture would be possible for the greater good?