Data Analytics for Business: How Data Can Improve Business Revenue

In the last edition of the Data Analytics for Business at The FinData Lake Newsletter, we discussed a very important question: How to incorporate Data-Driven Change. We’ve focused on the aspect of Changing Business Environments and how can we utilize internal Decision Support Systems and their benefits to organizations.

Moreover, in our new edition, we’ll concentrate more on the observable growth metrics and how can it improve business revenue.

After reading the first edition, you’ll start to grasp the concept of smart utilization of current digital systems and assets to maximize efficiency and profitability through multiple Business Intelligence methods. And you must have thought of a structure to implement at your workplace! Today, we’ll dive deep into the process together.

Today’s main question is: How can I use Data Analytics to benefit my business? Will it have a positive impact? and why should I care?

Organizations can involve in data in various ways, contingent upon their industry. For instance, in assembling associations, functional information obtained from frameworks and systems can uncover experiences like efficiency and proficiency execution. By understanding which cycles create setbacks, managers and senior directors can foster systems to smooth out basic functional regions.

Data Analysis and Analytics can also be used in various financial models. In today’s world, Banks and Institutions are shifting toward the mindset of Digital Transformation

Data can likewise help business capacities inside organizations. For instance, Finance Officers can oversight current and projected budget planning to compare and monitor daily activities, ensuring that the organization’s goal is adhered to, which reflects positively on financial control. Other data frameworks can reveal bits of knowledge that assist Finance supervisors with creating procedures to assist with holding top ability and construct a more useful and more dynamic Finance Environment.

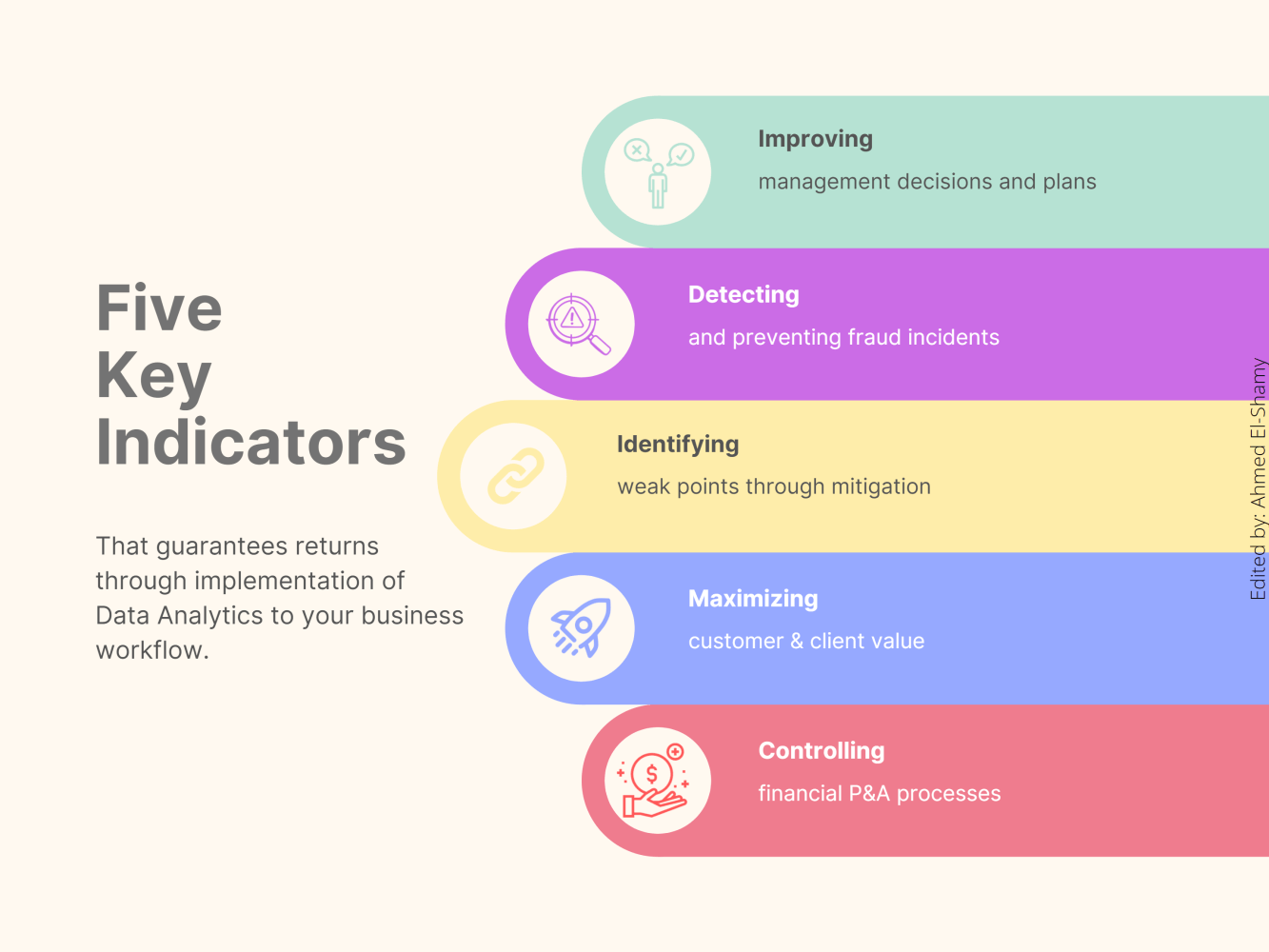

Through every analyst/officer/manager’s experiences, you’ll always find at least one of the Five Key Indicators that almost existed in every Data Analytics plan of any institution/organization. Implementing Data Analytics to your day-to-day activities will lead to tremendous positive effects that will shift your priorities to a much broader domain.

Below points are discussing how can Data Analytics have a positive return on your business in one way or another. which is reported to be one of the top-rated return-on-implication across institutions and organizations 🔝:

1️⃣⚖️ Improving Management Decisions

Numerous significant choices about a business require information about market patterns, client bases, and costs presented by contenders for the equivalent or comparable products or services. On the off chance that information doesn’t impact the dynamic cycle, it could cost the organization gigantically. For example, sending off another product in the market disregarding the cost of a contender’s product could make your item overrated – in this way making issues while attempting to increment deals. Data shouldn’t just apply to choices about products or services, yet additionally to different areas of business on the board.

Certain datasets will give data on how many employees it will take to encourage the effective working of a division. This will permit you to figure out where you are understaffed or congested.

2️⃣🥷🏻 Detecting Fraud Activities

As a business owner, the last thing that you want to have is a fake boost in sales through fraudulent activities or having a reported inventory of certain units that do not exist in the real world. As fraudulent crimes may occur either internally or externally. Both of which you can control.

But what will happen if you neglect it? Not only will it hurt your business numbers, but may also promote tremendous financial losses on your end. and if you do not have a controlled data management to monitor any fraud activity, you’re risking it all to the ground.

- Given the example of a normal purchase quantity of 10 units/day. And you’ve noticed that it peaked out at 300 units/day with a very small increase in client/customer engagement without having any current advertisement or external boost(s) can open your eye to the fact that someone may have used a payment method in which they do not own.

- Another example might be related to internal fraud activity. Where you have a purchase invoice of 10 units, but your current sales record shows that you’ve sold only 90 units. You’ll start to realize the unit differences and investigate where to look specifically.

3️⃣🔗 Identifying Weak Points

Assuming that a business is driven by foreordained processes or patterns, data can assist with distinguishing points of deviation. Little deviations from the standard can be the explanation for expanded client objections, diminished deals, or a decline in productivity. By gathering and dissecting information consistently, you will actually want to get a setback adequately early to forestall irreversible damages.

You can find more about identifying and reporting principles in the first edition of the Data Analytics for Business.

4️⃣📈 Maximizing Customer Value

At the point when you can identify those clients and customers, who are bound to return and do repeated business, it permits you to advance your promoting venture. Assembling long-haul associations with clients then expand their worth to you, and the degree of repeated business interactions.

You can be:

- Analyzing their frequent purchases and their niche favoritism.

- Looking for products that they wanted to purchase but they were hesitant/removed from the checkout page.

- Executing surge-purchase analysis at certain offer peak times.

And the rest is left to your imagination and how can you manipulate your current data assets for the ultimate goal of maximizing your customers’ values.

5️⃣💰 Controlling FP&A Processes

Organizations heavily depend on FP&A to achieve operational, financial, and strategic goals. Today’s Financial analysts work on designing forecast modules specifically designed to reflect how the business is currently behaving. Financial analysts may use generated internal system reports, ad-hoc reports, forecasting modules, and predictive worksheets. Financial analysts can assess business situations in coordination with other report lines to extract value and have a wiser decision that will impact positively on business goals.

Five of the benefits of using FP&A in your organization:

- Removing bias from decision-making by utilizing data assets, thus reflecting positively on the competitiveness of your business and so propels the growth of an organization.

- Useful for preparing timely reports from the FP&A analysis of existing data.

- Provides insights for decision-making on a timely basis.

- Helps establish clear goals for the organization in both the short and long term.

- Helps with risk mitigation.

🛫 THE TAKEAWAY

Having a strong analytical thinking culture in your organization will benefit all contributors one way or another. You remove bias from presented information, which will lead to a stronger and wiser decision for your business and will conclude more revenue based on these taken decisions. By developing and establishing such a plan, not only will you secure your seat against your competitors, but also improve and expand beyond your current business limitations to new heights that you have never thought of.

It’s not an easy road to adapt. You may need to develop and promote strategies to ensure everyone is on board with the data-driven culture; this can include creating a data dictionary, training, and skill-building programs. Eventually, it’ll pay off by multiples.

About me

I’m an articulate Data Analytics and Business Intelligence Expert with more than five years of progressive and continuous experience in the BI and Decision-Making field and project management, as well as 4 years of experience in the Finance sector. Personable with strong knowledge and experience in Operations, Risk, Data Analytics & Visualization. I am helping financial institutes and directors to perform accurate Financial Data Analysis & Analytics that will benefit in volume, growth, brand, and profits; and mitigate associated risks with taken actions.